The Geopolitical Importance of Central Asia

Central Asia. An expansive region that unfortunately eludes most people’s mind. Surrounded by neighbors that are constantly being buzzed about in the news, Central Asia itself rarely appears in newspapers, radio channels, news channels or blogs. It seems to have fallen off most people’s radar and has been simply forgotten by the rest of the world.

Unbeknownst to most, Central Asia is a region of great importance because of its overabundance of oil and natural gas. Currently, the Middle East has the largest reserves of oil and natural gas, but Central Asia has the potential of becoming the second runner-up as the world’s most important energy source with its 13 billion tons of gas (Luft 1).

Of the nations of the Caspian Sea basin, Kazakhstan has the largest oil reserves, with a total ranging from 9-40 billion barrels. It also has the largest natural gas reserves in the region, ranging from about 65-100 trillion cubic feet (Rummer 2007, 32). With such a huge amount of oil, even after the projected domestic needs of 35 Bcm by 2020, there will be plenty leftover for exportation (Stern 2008, 261). Turkmenistan, on the other hand, has focused its strength on its 2.9 trillion cubic meters of natural gas (Gokay 2001, 13; Stern 2008, 260). Because Turkmenistan has only 4 million people with an economy that is barely developed aside from oil and cotton, there is limited domestic consumption of its gas and thus a plethora of gas to export (260).

Unfortunately for the region, it is riddled with ethnic tension, civil wars, and cross-border conflicts. Also, these new states that are wedged between Russia to the north and Iran and Afghanistan to the south have always been historically dominated by outside powers and plagued by political instability and economic dependency (15). These states are not experienced in foreign affairs management and are especially vulnerable to the external pressures exerted by the US, Russia, and China when they continuously seek to establish their presence in the region (20).

For example, China is the second largest importer of oil and will most definitely overtake the US by 2030. With China’s huge population along with its high rates of economic growth and increasing demand for power generation, China will be looking for all the energy resources it can obtain (Stern 2008, 1).

The Chinese National Petroleum Company (CNPC) best represents China’s energy craze. Just to partially control the inflow of LNG, state-owned CNPC purchased the Canadian Petro-Kazakhstan Inc. well above the market value and was forced to sell a third of its holdings to the Kazakh state oil company KazMunaiGas (Fishelson).

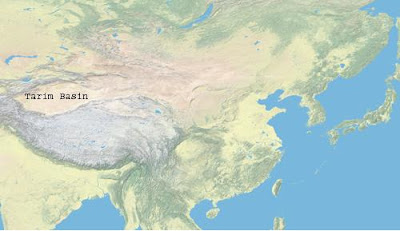

In 1997, Kazakhstan and China formed the Sino-Kazakh Oil Pipeline Co. Ltd, a joint venture between CNPC and KazMunaiGas whose goal was to construct a pipeline running from the Caspian Sea to Xingjiang (Fishelson). An initial 962 km section of the pipeline has already been constructed stretching from Atasu to Alataw. It first started pumping in May 2005, making it the first pipeline to pump crude oil directly into China (Fishelson). When the final stages of the pipeline are completed in 2011, the Kazakhstan oil pipeline (KCP) will stretch approximately 3000km across Kazakhstan connecting China to the Caspian fields (Fishelson).

The Kazakhstan-China pipeline is mutually beneficiary for both China and Kazakhstan: 1) there are no transit fees, 2) no other country can hold Kazakhstan’s oil by arbitrarily raising fees or closing the pipelines, 3) Kazakhstan will earn more money than selling oil to anywhere else because energy-deficient China will overpay for the oil, and 4) even in the case that relations between the two countries turn sour, Kazakhstan would probably not cut off its pumps to China because it would be shutting off such a large revenue generator (Fishelson). This pipeline has also weaned Kazakhstan from its dependence on exports to Russia (Stern 2008, 51).

These pipelines are the best examples of China’s international strategy to procure oil: obtaining petroleum via physical ownership instead of acquiring it by the international markets (Stern 2008, 40). China likes to deal with producers who are willing to allow China direct access to resources and construction of gas infrastructure (263).

The US holds only 2% of the world’s oil reserves but consumes roughly 25% of the world’s oil production (Fishelson). Like China, the US was an oil exporting country, but has become an energy importing nation as its oil reserves along with the number of wells being drilled decreased (Kayal 2002, 3). Currently, the US oil imports constitute a third of the US trade deficit (Luft 6). The US, however, has diversified the origins of its oil imports and though only 25% of the US oil originates from the Middle East, it controls 60% of the oil reserves in the Persian Gulf region (Kayal 2003, 3).

The EU depends on imports for 56% of its energy needs, of which 60% is dominated by oil and 25% is dominated by gas (Foratom). The EU’s crude energy sources are scarce and dependence on imported petroleum and gas is rapidly increasing. It was projected that in 2008, member states will probably produce only 19% of EU’s total oil expenditure, 37% of its natural gas usage, and 54% of its coal (Estonia in the European Union). Of the imported energy sources, the EU obtains 40% of its gas from Russia and this number is due to rise to 60% by 2030. Thus, the EU’s oil policies are directly affected by Russia’s.

Although Russia, unlike the US or China, does not need to import oil and natural gas to satisfy its domestic thirst, it seeks to dominate the transportation of energy especially to Europe (Fishelson). Russia has been seeking to combine its oil reserves with those of Central Asian so that Russia would become a petroleum super power and an equal rival of the Middle East. Currently, Russia is in the process of constructing the Nord Stream, a gas pipeline that will extend from Vyborg (near St. Petersburg) under the Baltic Sea and into Germany. This will bypass Eastern Europe and free Russia from transit fees. More importantly, this will give Russia full vertical control of its gas, from exploration, to drilling, to refinement, to sales and will thus have a monopoly over the prices of oil as well. This has alarmed the US in particular who has been advocating the establishment of new oil and gas pipelines that would avoid Russia and diminish its control over the regional flow of energy (Klare). The US fears that if Russia were to gain full control of the oil inflows into Europe, then it will undercut the US’s influence in the region.

With the discovery of oil, many of these countries, such as Kazakhstan and Turkmenistan, now have the opportunity to grasp their own destinies, and if done correctly, their exploited oil and gas could become the driving force for developing their country’s economy. However, this greater global interdependence between developing and first world countries also has its pros and cons. The symbiotic relationship provides the superpowers the fuel to propel their industries but also increases its dependency on the suppliers: if there is a shortage of oil or a hike in prices, it could bring the developed economies to the verge of collapse and further endanger our political systems. Especially in this world where natural resources are limited, it has become strategically imperative for countries to secure their access in the Central Asia. China, Russia, and the US have already started establishing their alliances with these two regions in their own preferred ways and though no one seems to be the apparent winner, the competition will only become more intense as the world continues to vie for the same resources.

Works Cited

1) Fishelson, James . "From the Silk Road to Chevron: The Geopolitics of Oil Pipelines in Central Asia." The School of Russian and Asian Studies. 12 Dec 2007. 11 Dec 2008 .

2) Gokay, Bulent. The Politics of Caspian Oil. New York City: Palgrave Publishers Ltd., 2001.

3) Issawi, Charles. Oil, The Middle East and the World. 2nd. London: Sage Publications, 1972.

4) Kayal, Alawi. The Control of Oil. London: Kegan Paul Limited, 2002.

5) Klare, Michael T. "The New Geopolitics of Energy ." The Nation 01 MAY 2008 18 Nov 2008.

6) Luft, Gal. "Dependence on Middle East energy and its impact on global security." Institute for the Analysis of Global Security. IAGS. 11 Dec 2008.

-Submitted by Vivian Zhang (CAS '11)

2) Gokay, Bulent. The Politics of Caspian Oil. New York City: Palgrave Publishers Ltd., 2001.

3) Issawi, Charles. Oil, The Middle East and the World. 2nd. London: Sage Publications, 1972.

4) Kayal, Alawi. The Control of Oil. London: Kegan Paul Limited, 2002.

5) Klare, Michael T. "The New Geopolitics of Energy ." The Nation 01 MAY 2008 18 Nov 2008

6) Luft, Gal. "Dependence on Middle East energy and its impact on global security." Institute for the Analysis of Global Security. IAGS. 11 Dec 2008

Vivian, I was wondering what class this was for. It semes interesting.

ReplyDeleteIt was for an anthropology class... i think anth012?

ReplyDeleteA good, informative review.

ReplyDelete